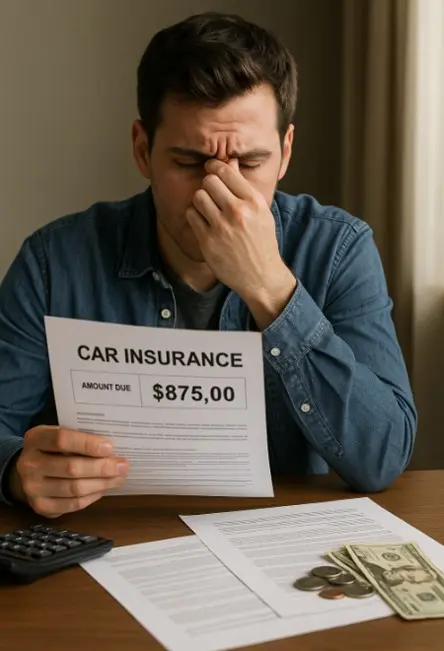

Many drivers struggle to pay for car insurance because of high prices. Monthly installment insurance plans let people spread out their payments. This post will show how these plans make it easier to afford coverage.

Keep reading to learn more!

Understanding Monthly Installment Insurance Plans

Monthly installment insurance plans let drivers pay for their car insurance in smaller amounts each month. This breaks down the total cost into manageable pieces. With these plans, instead of paying the full price upfront once a year, you spread it out.

You get the same coverage but in a way that fits better with monthly budgets.

What if you need car insurance now, pay later? That’s where monthly installment plans shine. They offer a solution by allowing immediate coverage without the big initial payment. Drivers can start their policy and then pay overtime, making it easier to handle financially.

Benefits of Monthly Installment Plans

Monthly installment insurance plans make budget management easier, and they also provide increased accessibility to coverage. These benefits create a more flexible and manageable option for drivers seeking insurance.

Easier Budget Management

Paying for car insurance in monthly installments helps you manage your money better. You can plan your spending each month without worrying about a big bill once a year. This way, if you need car insurance now and pay later, you’re not stuck.

It makes staying covered easier because you can fit the cost into your regular budget.

People find it less stressful to handle smaller payments spread out over time. They use tools like the Gladiators Insurance quote comparison tool to find options that match their financial situation.

This approach lets drivers keep their coverage without cutting back on other essentials.

Increased Accessibility to Coverage

Managing a budget better allows more people to afford car insurance. Monthly installment plans play a big part in this. These plans make it possible for drivers who need car insurance now but prefer to pay later.

This way, no one must go without coverage just because they can’t pay all at once.

Monthly payments open doors for many to get insured.

Some providers even offer on-the-spot car insurance, allowing drivers to activate coverage instantly while paying monthly.

With these plans, buying insurance becomes less scary and more doable. People find it easier to start their coverage since they don’t have to save up for a huge payment first. They can simply include their insurance costs into their monthly budgets and enjoy the peace of mind that comes with being covered right away.

How Drivers Are Adopting Monthly Installment Plans

Drivers are embracing monthly installment plans because they offer flexible payment options and reduce financial strain. Monthly installments make it easier for drivers to manage their budget while ensuring they have continuous coverage.

Flexible Payment Options

Monthly installment insurance plans offer drivers the flexibility to spread their premium payments over several months rather than paying a large lump sum upfront. This can help ease financial strain and make car insurance more affordable for those on tight budgets.

With this payment option, drivers can align their insurance costs with their income schedule and manage their expenses more effectively.

By allowing customers to pay for coverage in smaller, manageable installments, monthly installment plans provide greater accessibility to essential protection. This ensures that individuals who may struggle with high annual premiums have the opportunity to maintain continuous coverage without facing financial hardship or sacrificing other necessities.

Reduced Financial Strain

Drivers are embracing monthly installment insurance plans because they can reduce financial strain. These plans allow drivers to spread out the cost of their insurance over several months instead of paying a large sum upfront.

This can help ease the burden on their wallets, making it more manageable for those who may find it difficult to pay a lump sum all at once.

Moreover, breaking down the payments into manageable monthly installments can make car insurance more affordable and accessible, especially for individuals who need car insurance now but prefer to pay later.

This approach aligns with the current economic climate, where many people are looking for flexible payment options that fit within their budget constraints.

Comparing Monthly vs. Annual Payments

Choosing between monthly and annual payments can make a big difference for drivers. Here’s a look at how these options stack up.

| Aspect | Monthly Payments | Annual Payments |

| Cash Flow Impact | Smaller, manageable amounts | One large payment |

| Flexibility | High, adjust as needed | Low, locked in for a year |

| Accessibility | Easier for those on tight budgets | Best for those with more upfront cash |

| Discounts | Fewer, if any | Often offers savings for paying upfront |

| Administration | More frequent payments, possibly more admin | Less frequent, simpler to manage |

Paying monthly offers flexibility and easier budget management. Annual payments can save money but require more upfront. Moving on, let’s explore some tips for choosing the right installment plan.

Tips for Choosing the Right Installment Plan

Here are some tips to help you choose the right installment plan for your car insurance:

- Compare Different Plans: Look at multiple insurance companies and the installment plans they offer. Consider the coverage, premiums, and payment terms carefully.

- Assess Your Budget: Determine how much you can afford to pay each month for your car insurance. Ensure that the monthly payments fit comfortably within your budget.

- Review Deductibles: Understand the deductibles associated with each plan. A higher deductible could mean lower monthly installments but may require more out-of-pocket expenses in the event of a claim.

- Consider Discounts: Inquire about discounts available for paying in installments or meeting specific criteria, such as a good driving record or bundling policies.

- Research Customer Satisfaction: Look into customer reviews and satisfaction ratings for each insurance company and their installment plans.

- Seek Professional Advice: If you’re uncertain about which plan is best for you, consider consulting with an insurance agent or financial advisor to guide your decision-making process.

Conclusion

Struggling with high insurance premiums? Monthly installment plans could be your solution. These plans offer easier budget management and increased accessibility to coverage. Drivers are embracing them for flexible payment options and reduced financial strain.

When comparing monthly versus annual payments, consider the benefits of each option to choose what suits you best. So, if high premiums are weighing you down, monthly installment plans might just be the way forward for you.

Also Read-V4Holt: Leading Advances in Innovative Tech